2022 Notice of Annual Meeting

and Proxy Statement

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

Mister Car Wash, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2022 Notice of Annual Meeting

and Proxy Statement

Mister Car Wash, Inc.

222 E. 5th Street

Tucson, Arizona 85705

April 12, 2022

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the 2022 annual meeting of stockholders (the “Annual Meeting”) of Mister Car Wash, Inc., which will be held on Wednesday, May 25, 2022, beginning at 10:00 a.m., Mountain Standard Time, at 415 N. 6th Avenue, Tucson, Arizona 85705.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on March 31, 2022, a Notice of Internet Availability of Proxy Materials. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the meeting.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the Annual Meeting. Please vote electronically over the Internet, by telephone, by Alexa, or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors and management, it is my pleasure to express our appreciation for your continued support.

|

| John Lai |

| Chairperson, President and Chief Executive Officer |

Mister Car Wash, Inc.

222 E. 5th Street

Tucson, Arizona 85705

Notice of Annual Meeting of Stockholders to be Held on May 25, 2022

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Mister Car Wash, Inc., a Delaware corporation, will be held on Wednesday, May 25, 2022, at 10:00 a.m., Mountain Standard Time, at 415 N. 6th Avenue, Tucson, Arizona 85705.

The Annual Meeting is being held:

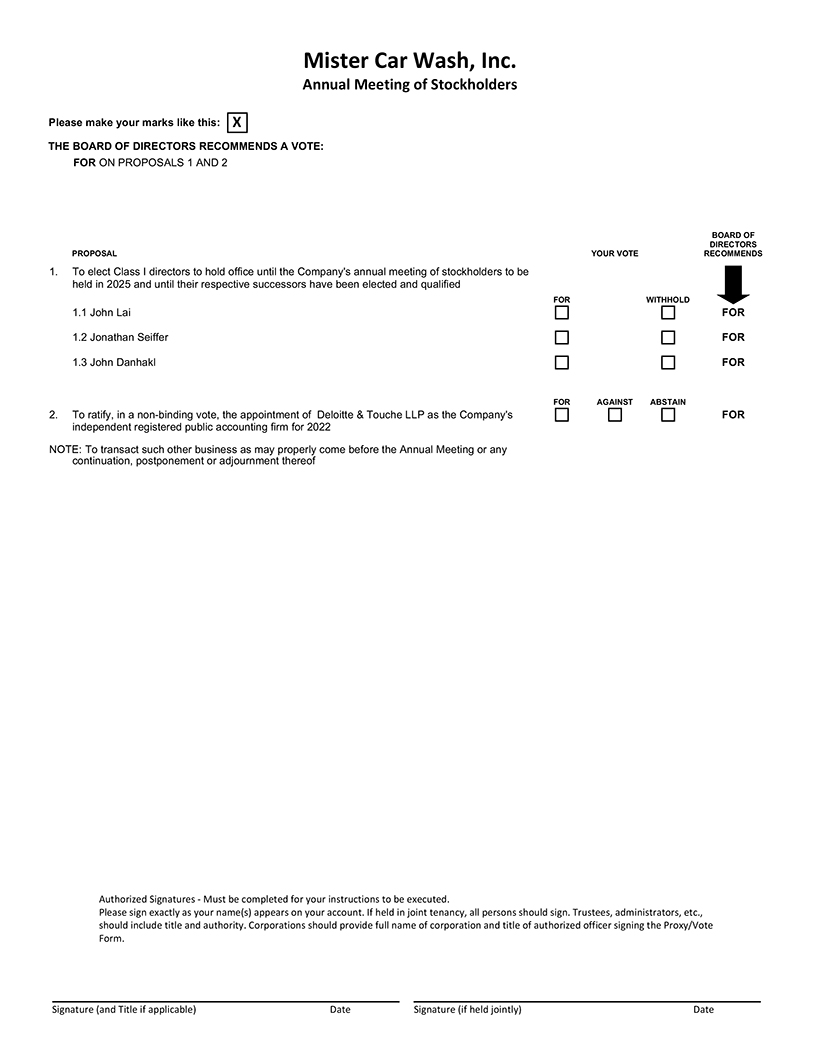

| 1. | to elect John Lai, Jonathan Seiffer and John Danhakl as Class I directors to hold office until the Company’s annual meeting of stockholders to be held in 2025 and until their respective successors have been duly elected and qualified; |

| 2. | to ratify, in a non-binding vote, the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2022; and |

| 3. | to transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

These items of business are described in the Proxy Statement that follows this notice. Holders of record of our common stock as of the close of business on March 31, 2022 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment thereof.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Please promptly vote your shares by following the instructions for voting on the Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet, telephone, or Alexa voting as described on your proxy card.

| By Order of the Board of Directors |

|

| John Lai |

| Chairperson, President and Chief Executive Officer |

Tucson, Arizona

April 12, 2022

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 12, 2022.

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting:

|

||||

|

This Proxy Statement and our Annual Report are available free of charge at www.investorelections.com/MCW

| ||||

| 2022 Proxy Statement |

|

i | ||||||

Mister Car Wash, Inc.

222 E. 5th Street

Tucson, Arizona 85705

Proxy Statement

For the Annual Meeting of Stockholders

to be held on May 25, 2022

This proxy statement (the “Proxy Statement”) and our annual report for the fiscal year ended December 31, 2021 (the “Annual Report” and, together with this Proxy Statement, the “proxy materials”) are being furnished by and on behalf of the board of directors (the “Board” or “Board of Directors”) of Mister Car Wash, Inc. (the “Company,” “Mister,” “we,” “us,” or “our”), in connection with our 2022 annual meeting of stockholders (the “Annual Meeting”). The Notice of Annual Meeting and this Proxy Statement are first being distributed or made available, as the case may be, on or about April 12, 2022.

General Information About the Annual Meeting and Voting

When and where will the Annual Meeting be held?

The Annual Meeting will be held on Wednesday, May 25, 2022 at 10:00 a.m., Mountain Standard Time at 415 N. 6th Avenue, Tucson, Arizona 85705. To obtain directions to attend the Annual Meeting in person, please contact our Investor Relations team at IR@mistercarwash.com.

What are the purposes of the Annual Meeting?

The purpose of the Annual Meeting is to vote on the following items described in this Proxy Statement:

| • | Proposal No. 1: Election of the director nominees listed in this Proxy Statement. |

| • | Proposal No. 2: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2022. |

Are there any matters to be voted on at the Annual Meeting that are not included in this Proxy Statement?

At the date this Proxy Statement went to press, we did not know of any matters to be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a paper copy of proxy materials?

The rules of the Securities and Exchange Commission (the “SEC”) permit us to furnish proxy materials, including this Proxy Statement and the Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Stockholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice and Access Card”) provides instructions on how to access and review on the Internet all of the proxy materials. The Notice and Access Card also instructs you as to how to authorize

| 2022 Proxy Statement |

|

1 | ||||||

Proxy Statement

via the Internet, telephone, or Alexa your proxy to vote your shares according to your voting instructions. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials described in the Notice and Access Card.

What does it mean if I receive more than one Notice and Access Card or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Notice and Access Card or set of proxy materials, please submit your proxy by phone, the Internet, or Alexa or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

Can I vote my shares by filling out and returning the Notice and Access Card?

No. The Notice and Access Card identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and Access Card and returning it. If you would like a paper proxy card, you should follow the instructions in the Notice and Access Card. The paper proxy card you receive will also provide instructions as to how to authorize via the Internet, telephone, or Alexa your proxy to vote your shares according to your voting instructions. Alternatively, you can mark the paper proxy card with how you would like your shares voted, sign and date the proxy card, and return it in the envelope provided.

Who is entitled to vote at the Annual Meeting?

Holders of record of shares of our common stock as of the close of business on March 31, 2022 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment thereof. At the close of business on the Record Date, there were 301,607,178 shares of our common stock issued and outstanding and entitled to vote. Each share of common stock is entitled to one vote.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder (also called a “registered holder”) holds shares in his or her name. Shares held in “street name” means that shares are held in the name of a bank, broker or other nominee on the holder’s behalf.

What do I do if my shares are held in “street name”?

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” The Notice and Access Card or the proxy materials, if you elected to receive a hard copy, has been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The holders of a majority in voting power of the stock issued and outstanding and entitled to vote, present in person, or by remote communication, if applicable, or represented by proxy, constitutes a quorum. If you sign and return your paper proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

Broker non-votes will also be considered present for the purpose of determining whether there is a quorum for the Annual Meeting.

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially

| 2 |

|

2022 Proxy Statement | ||||||

Proxy Statement

owns the shares and (2) the broker lacks the authority to vote the shares at their discretion. Proposal No. 1 is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Proposal No. 2 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on this proposal.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present or represented at the scheduled time of the Annual Meeting, (i) the chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or by remote communication, if applicable, or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

How do I vote my shares without attending the Annual Meeting?

We recommend that stockholders vote by proxy even if they plan to attend the Annual Meeting and vote in person. If you are a stockholder of record, there are four ways to vote by proxy:

| • | by Internet — You can vote over the Internet at www.proxypush.com/MCWby following the instructions on the Notice and Access Card or proxy card; |

| • | by Telephone — You can vote by telephone by calling 866-447-0865and following the instructions on the proxy card; |

| • | by “Alexa, Vote My Proxy” — You can vote by opening your Alexa app and following the instructions on the proxy card; or |

| • | by Mail — You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail. |

Internet and Telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on May 24, 2022.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions on how to vote from the bank, broker or holder of record. You must follow the instructions of such bank, broker or holder of record in order for your shares to be voted.

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted during or prior to the meeting that are pertinent to the Company and the meeting matters, as time permits. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

| • | irrelevant to the business of the Company or to the business of the Annual Meeting; |

| • | related to material non-public information of the Company, including the status or results of our business since our Annual Report on Form 10-K; |

| • | related to any pending, threatened or ongoing litigation; |

| • | related to personal grievances; |

| • | derogatory references to individuals or that are otherwise in bad taste; |

| • | substantially repetitious of questions already made by another stockholder; |

| • | in excess of the two question limit; |

| • | in furtherance of the stockholder’s personal or business interests; or |

| • | out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Corporate Secretary in their reasonable judgment. |

How does the Board recommend that I vote?

The Board recommends that you vote:

| • | FOR the nominees to the Board set forth in this Proxy Statement. |

| • | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2022. |

| 2022 Proxy Statement |

|

3 | ||||||

Proxy Statement

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

| Proposal |

Votes Required | Voting Options | Impact of “Withhold” or “Abstain” Votes |

Broker Discretionary Allowed | ||||

| Proposal No. 1: Election of Directors |

The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I directors. | “FOR ALL” “WITHHOLD ALL” “FOR ALL EXCEPT” |

None(1) | No(3) | ||||

| Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes) on such matter. | “FOR” “AGAINST” “ABSTAIN” |

None(2) | Yes(4) |

| (1) | Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. |

| (2) | A vote marked as an “Abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. |

| (3) | As this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. |

| (4) | As this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal, and we do not expect any broker non-votes on this matter. |

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth above, as well as with the description of each proposal in this Proxy Statement.

Representatives of Mediant Communications (“Mediant”) will tabulate the votes, and a representative of Mediant will act as inspector of election.

Can I revoke or change my vote after I submit my proxy?

Yes. Whether you have voted by Internet, telephone. Alexa or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

| • | sending a written statement to that effect to the attention of our Corporate Secretary at our corporate offices, provided such statement is received no later than May 24, 2022; |

| • | voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Time, on May 24, 2022; |

| • | submitting a properly signed proxy card with a later date that is received no later than May 24, 2022; or |

| • | attending the Annual Meeting, revoking your proxy and voting again. |

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Your most recent proxy card or telephone, Alexa or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote at the Annual Meeting.

| 4 |

|

2022 Proxy Statement | ||||||

Proxy Statement

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

| 2022 Proxy Statement |

|

5 | ||||||

Proposal No. 1 Election of Directors

Our amended and restated certificate of incorporation, as currently in effect (“Certificate of Incorporation”) provides that the number of directors shall be established from time to time by our Board of Directors. Our Board of Directors has fixed the number of directors at ten, and we currently have ten directors serving on the Board.

Our Certificate of Incorporation provides that the Board be divided into three classes, designated as Class I, Class II and Class III. Each class of directors must stand for re-election no later than the third annual meeting of stockholders subsequent to their initial appointment or election to the Board, provided that the term of each director will continue until the election and qualification of his or her successor and is subject to his or her earlier death, resignation or removal. Generally, vacancies or newly created directorships on the Board will be filled only by vote of a majority of the directors then in office although less than a quorum, or by a sole remaining director. A director appointed by the Board to fill a vacancy will hold office until the next election of the class for which such director was chosen, subject to the election and qualification of his or her successor and his or her earlier death, resignation, retirement, disqualification, or removal.

Our current directors and their respective classes and terms are set forth below.

| Class I Directors - Current Term Ending at 2022 Annual Meeting |

Class II Directors — Current Term Ending at 2023 Annual Meeting |

Class III Directors — Current Term Ending at 2024 Annual Meeting | ||

| John Lai | J. Kristofer Galashan | Dorvin Lively | ||

| Jonathan Seiffer | Jeffrey Suer | Susan Docherty | ||

| John Danhakl | Ronald Kirk | Jodi Taylor | ||

| Veronica Rogers |

Messrs. Lai, Seiffer and Danhakl have been nominated by the Board to stand for election. As the directors assigned to Class I, Messrs. Lai, Seiffer and Danhakl’s current terms of service will expire at the Annual Meeting. If elected by the stockholders at the Annual Meeting, Messrs. Lai, Seiffer and Danhakl will each serve for a term expiring at our annual meeting of stockholders to be held in 2025 (the “2025 Annual Meeting”) and the election and qualification of his successor or until his earlier death, resignation, retirement, disqualification, or removal.

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. If, however, prior to the Annual Meeting, the Board of Directors should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for this nominee will be voted for a substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board has no reason to believe that any of the nominees will be unable to serve.

Information About Board Nominees and Continuing Directors

The following pages contain certain biographical information as of April 12, 2022 for each nominee for director and each director whose term as a director will continue after the Annual Meeting, including all positions he or she holds, his or her principal occupation and business experience for the past five years, and the names of other publicly-held companies of which the director or nominee currently serves as a director or has served as a director during the past five years.

| 6 |

|

2022 Proxy Statement | ||||||

Proposal No. 1 Election of Directors

Board Composition and Expertise

We believe that each of our directors has the experience, skills, qualities and time to successfully perform his or her duties as a director and contribute to our Company’s success. In selecting these directors, the Board determined each to be of high integrity and good judgment, with a record of accomplishment in their chosen fields, and displaying the independence of mind and strength of character to effectively represent the best interests of all stockholders and provide practical insights and diverse perspectives. Our directors are diverse in age, gender, tenure, ethnic background and professional experience: 30% identify as female, 10% identify as African American and 10% identify as multiracial. Together they produce a cohesive body in terms of board process, collaboration, and mutual respect for differing perspectives. For more information on Mister’s director nomination process, see Nomination and Corporate Governance Committee — Director Nomination Process.

The information presented below regarding each nominee and continuing director also sets forth specific experience, qualifications, attributes and skills that led our Board of Directors to the conclusion that such individual should serve as a director in light of our business and structure.

Nominees for Election to Three-Year Terms Expiring No Later than the 2025 Annual Meeting

| Class I Directors |

Age | Director Since | Current Position at Mister | |||||

| John Lai |

58 | 2013 | Chief Executive Officer and Director | |||||

| Jonathan Seiffer |

50 | 2014 | Director | |||||

| John Danhakl |

66 | 2014 | Director | |||||

John Lai has served as our President and Chief Executive Officer and as a member of our board of directors since June 2013, and previously served as our Vice President of Market Development. Mr. Lai joined Mister Car Wash in 2002. Mr. Lai has served as a director at the Southern Arizona Leadership Council since December 2019. Mr. Lai received a B.S. from the University of Arizona. We believe that Mr. Lai is qualified to serve on our board of directors based on his understanding of our business and operations and perspective as our President and Chief Executive Officer.

Jonathan Seiffer has served as a member of our board of directors since August 2014. Mr. Seiffer is a Senior Partner at Leonard Green & Partners, a private equity investing firm, which he joined as an Associate in October 1994. Mr. Seiffer has also served on the board of directors of Signet Jewelers, LTD since 2019, AerSale Corporation since December 2020 and previously served on the Boards of Directors of Whole Foods Market, Inc. from 2008 to 2017 and BJ’s Wholesale Club from 2011 to 2020. Mr. Seiffer obtained a B.S. in finance and systems engineering from the University of Pennsylvania. We believe Mr. Seiffer is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies.

John Danhakl has served as a member of our board of directors since August 2014. Mr. Danhakl has served as the Managing Partner of Leonard Green & Partners, a private equity investing firm, since 1995. Mr. Danhakl has also served on the board of directors of IQVIA Holdings Inc. since February 2010 and Life Time Group Holdings, Inc. since June 2015. Mr. Danhakl received an M.B.A. from Harvard Business School, and a B.A. in economics from the University of California, Berkeley. We believe Mr. Danhakl is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies, and his experience as a financial analyst.

Class II Directors Whose Terms Expire at the 2023 Annual Meeting of Stockholders

| Class II Directors |

Age | Director Since | Current Position at Mister | |||||

| J. Kristofer Galashan |

44 | 2014 | Director | |||||

| Jeffrey Suer |

36 | 2014 | Director | |||||

| Ronald Kirk |

67 | 2021 | Director | |||||

| Veronica Rogers |

44 | 2021 | Director | |||||

J. Kristofer Galashan has served as a member of our board of directors since August 2014. Mr. Galashan is a Partner of Leonard Green & Partners where he joined as an associate in 2002. Mr. Galashan also serves on the board of directors of

| 2022 Proxy Statement |

|

7 | ||||||

Proposal No. 1 Election of Directors

the following companies: USHG Acquisition Corp. since February 2021, Life Time Group Holdings, Inc. since March 2015, Container Store Group, Inc. since August 2007 and previously served on the board of directors for BJ’s Wholesale Club Holdings, Inc. from 2011 to 2019. Mr. Galashan earned a B.A. in Honors Business Administration from the Richard Ivey School of Business at the University of Western Ontario. We believe Mr. Galashan is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies.

Jeffrey Suer has served as a member of our board of directors since August 2014. Mr. Suer is a Principal at Leonard Green & Partners, a private equity investing firm. Prior to joining Leonard Green & Partners in August 2013, Mr. Suer previously served as a private equity associate at Apollo Global Management LLC and a mergers and acquisitions analyst at Morgan Stanley. Mr. Suer received an M.B.A. from Harvard Business School, and a B.S. in Mathematics/Economics from the University of California, Los Angeles. We believe Mr. Suer is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies.

Ronald Kirk has served as a member of our board of directors since October 2021. Mr. Kirk has been Senior Of Counsel at the law firm of Gibson, Dunn & Crutcher LLP since March 2013 and co-chairs the International Trade Practice Group. From 2009 until 2013, Mr. Kirk served as the U.S. Trade Representative under President Obama, where he focused on the development and enforcement of U.S. intellectual property law. Prior to serving as U.S. Trade Representative, from 2005 to 2009, Mr. Kirk was a partner of the law firm of Vinson & Elkins LLP and, from 1994 to 2005, was a partner in the Corporate Securities Practice of Gardere Wynne & Sewell LLP. Mr. Kirk currently serves on the board of Texas Instruments Incorporated and the board of Macquarie Infrastructure Holdings, LLC. Mr. Kirk received a B.A. in Political Science and Sociology from Austin College and a J.D. from University of Texas at Austin School of Law. We believe Mr. Kirk is qualified to serve on our board of directors due to his broad leadership experience and experience as an independent director for other public companies.

Veronica Rogers has served as a member of our board of directors since October 2021. Ms. Rogers has served as Senior Vice President, Head of Global Sales and Business Operations of Sony Interactive Entertainment LLC since January 2020. From 2006 to 2020, she served in various managerial roles in sales, marketing and business development at Microsoft Corporation, most recently as Vice President, Device Partner, Sales from 2018 to 2020. Ms. Rogers received a B.A. in Economics and a Master of Arts degree in Economics from the University of Cambridge, as well as a Master of Science degree in European Political Economy and Political Science from the London School of Economics. We believe Ms. Rogers is qualified to serve on our board of directors due to her experience as an executive officer of public companies.

Class III Directors Whose Terms Expire at the 2024 Annual Meeting of Stockholders

| Class III Directors |

Age | Director Since | Current Position with Mister | |||||

| Dorvin Lively |

63 | 2021 | Director | |||||

| Susan Docherty |

59 | 2021 | Director | |||||

| Jodi Taylor |

59 | 2021 | Director | |||||

Dorvin Lively has served as a member of our board of directors since June 2021. Mr. Lively has also served as the President of Planet Fitness, Inc. since May 2017, and previously served as their Chief Financial Officer from July 2013 until January 2019. Mr. Lively previously served as Executive Vice President, Chief Financial Officer, interim Chief Executive Officer and Chief Administrative Officer for RadioShack Corporation from August 2011 to July 2013, and prior to RadioShack, Mr. Lively served as Chief Financial Officer at Ace Hardware Corp. Mr. Lively has served as Director and Chair of the Audit Committee for European Wax Center, Inc. since March 2021. Mr. Lively received a B.A. from the University of Arkansas. We believe Mr. Lively is qualified to serve on our board of directors due to his experience as an executive officer at industry leading retail and service companies.

Susan Docherty has served as a member of our board of directors since June 2021. Ms. Docherty is the former Chief Executive Officer of Canyon Ranch and served in this position from May 2015 to August 2019. Ms. Docherty has also served as a member of the board of directors of The Brink’s Company since May 2014 where she has served on the compensation committee since January 2016, and the finance committee since May 2014. Ms. Docherty received a Master of Science in Management from the Stanford Graduate School of Business, and a B.A. in Economics and an Honors Business Administration degree from the University of Windsor. We believe Ms. Docherty is qualified to serve on our board of directors because of her extensive executive-level experience at consumer sales and marketing companies.

| 8 |

|

2022 Proxy Statement | ||||||

Proposal No. 1 Election of Directors

Jodi Taylor has served as a member of our board of directors since June 2021. Ms. Taylor previously served as an executive officer of Container Store Group, Inc., a publicly traded specialty retailer of storage and organization products, until her retirement in March 2021. She was the Chief Financial Officer from December 2007 through August 2020, the Secretary from October 2013 through March 2021, and the Chief Administrative Officer from July 2016 through March 2021. Prior to joining Container Store Group, Inc., Ms. Taylor spent nine years as the Chief Financial Officer and Secretary of Harold’s Stores, Inc., a regional specialty retailer of high-end apparel. Since August 2020, Ms. Taylor has served on the board of directors of the J.M. Smucker Company, where she also serves on the audit committee and nominating committee. She has been a certified public accountant since 1984, starting with an accounting role at Deloitte & Touche L.L.P. We believe Ms. Taylor is qualified to serve on our board of directors due to her experience as an executive officer of a public company and her financial and accounting expertise.

|

|

||||

|

The Board of Directors unanimously recommends a vote FOR the election of each of John Lai, Jonathan Seiffer and John Danhakl as a Class I director to hold office until the 2025 Annual Meeting and until his respective successor has been duly elected and qualified.

| ||||

| 2022 Proxy Statement |

|

9 | ||||||

Proposal No. 2 Ratification of Appointment of Independent Registered

Public Accounting Firm

Appointment of Independent Registered Public Accounting Firm

The Audit Committee appoints our independent registered public accounting firm. In this regard, the Audit Committee evaluates the qualifications, performance and independence of our independent registered public accounting firm and determines whether to re-engage our current firm. As part of its evaluation, the Audit Committee considers, among other factors, the quality and efficiency of the services provided by the firm, including the performance, technical expertise, industry knowledge and experience of the lead audit partner and the audit team assigned to our account; the overall strength and reputation of the firm; the firm’s global capabilities relative to our business; and the firm’s knowledge of our operations. Deloitte & Touche LLP has served as our independent registered public accounting firm since 2018. Upon consideration of these and other factors, the Audit Committee has appointed Deloitte & Touche LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

Although ratification is not required by our amended and restated bylaws (“Bylaws”) or otherwise, the Board is submitting the selection of Deloitte & Touche LLP to our stockholders for ratification because we value our stockholders’ views on the Company’s independent registered public accounting firm and it is a good corporate governance practice. If our stockholders do not ratify the selection, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Representatives of Deloitte & Touche LLP are expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

Audit, Audit-Related, Tax and All Other Fees

The following table sets forth the fees of Deloitte & Touche LLP, our independent registered public accounting firm, billed to the Company in each of the last two fiscal years.

| Year Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Audit Fees |

$ | 921,637 | $ | 605,500 | ||||

| Audit-Related Fees |

1,694,875 | 201,584 | ||||||

| Tax Fees |

591,481 | 733,515 | ||||||

| All Other Fees |

— | 1,895 | ||||||

| Total |

$ | 3,207,993 | $ | 1,542,494 | ||||

Audit fees for the fiscal years ended December 31, 2021 and December 31, 2020 consisted of fees billed for professional services rendered for the audit and interim reviews of Mister’s financial statements.

Audit-related fees for the fiscal years ended December 31, 2021 and December 31, 2020 consisted of fees billed for work performed in connection with SEC filings related to registration statements and comfort letters issued to underwriters, and merger and acquisition due diligence services provided in connection with potential acquisitions.

Tax fees for the fiscal years ended December 31, 2021 and December 31, 2020 consisted of fees related to federal and state income tax and indirect tax return compliance and consulting matters.

All other fees for the fiscal years ended December 31, 2021 and December 31, 2020 consisted of licensing fees for accounting research software.

| 10 |

|

2022 Proxy Statement | ||||||

Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm

Pre-Approval Policies and Procedures

The formal written charter for our Audit Committee requires that the Audit Committee pre-approve all audit services to be provided to us, whether provided by our principal auditor or other firms, and all other services (review, attest and non-audit) to be provided to us by our independent registered public accounting firm, other than de minimis non-audit services approved in accordance with applicable SEC rules.

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by our independent registered public accounting firm may be pre-approved. The Pre-Approval Policy generally provides that the Audit Committee will not engage an independent registered public accounting firm to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by our independent registered public accounting firm has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any member of the Audit Committee to whom the committee delegates authority to make pre-approval decisions must report any such pre-approval decisions to the Audit Committee at its next scheduled meeting. If circumstances arise where it becomes necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval categories or above the pre-approved amounts, the Audit Committee requires pre-approval for such additional services or such additional amounts. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence.

On an annual basis, the Audit Committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by our independent registered accounting firm without first obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations.

The above-described services provided to us by Deloitte & Touche LLP prior to our initial public offering, effective June 24, 2021 (“IPO) were provided under engagements entered into prior to our adoption of our pre-approval policies and, following our IPO, in accordance with such policies.

|

|

||||

|

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022.

| ||||

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board and serves as the primary communication link between the Board as representative of our stockholders, our independent registered public accounting firm and our internal auditors. The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. Additionally, a brief description of the primary responsibilities of the Audit Committee is included in this Proxy Statement under the discussion of “Corporate Governance — Audit Committee.” Under the Audit Committee charter, management is responsible for the preparation, presentation and integrity of the Company’s financial statements, the appropriateness of accounting principles and financial reporting policies and for establishing and maintaining our internal control over financial reporting. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

| 2022 Proxy Statement |

|

11 | ||||||

Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm

In the performance of its oversight function, the Audit Committee reviewed and discussed with management and Deloitte & Touche LLP, as the Company’s independent registered public accounting firm, the Company’s audited financial statements for the fiscal year ended December 31, 2021. The Audit Committee also discussed with the Company’s independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”). In addition, the Audit Committee received and reviewed the written disclosures and the letters from the Company’s independent registered public accounting firm required by applicable requirements of the PCAOB, regarding such independent registered public accounting firm’s communications with the Audit Committee concerning independence and discussed with the Company’s independent registered public accounting firm their independence from the Company.

Based upon the review and discussions described in the preceding paragraph, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC.

Submitted by the Audit Committee of the Company’s Board of Directors

Jodi Taylor (Chair)

Dorvin Lively

Susan Docherty

| 12 |

|

2022 Proxy Statement | ||||||

The table below identifies and sets forth certain biographical and other information regarding our executive officers as of April 12, 2022. There are no family relationships among any of our executive officers or directors.

| Executive Officer |

Age | Position | In Current Position Since |

|||||||

| John Lai |

58 | Chief Executive Officer, President and Director | 2013 | |||||||

| Jedidiah Gold |

42 | Chief Financial Officer | 2019 | |||||||

| Lisa Bossard Funk |

63 | General Counsel | 2015 | |||||||

| Mayra Chimienti |

38 | Chief Operating Officer | 2022 | |||||||

| Casey Lindsay |

40 | Vice President, Corporate Development | 2017 | |||||||

See page 7 of this Proxy Statement for the biography of John Lai.

Jedidiah Gold has served as our Treasurer and Chief Financial Officer since July 2019. Mr. Gold previously served as Senior Director Finance, Assistant Treasurer at Yum Brands, Inc. from May 2016 to July 2019, and as Chief Financial Officer MENAPak at KFC Corporation from October 2014 to May 2016. Mr. Gold has served as a director for the Mister Cares Foundation since April 2020. Mr. Gold received an M.B.A. in Finance and Accounting from Indiana University and a B.S. in accounting from the University of Utah.

Lisa Bossard Funk has served as our Corporate Secretary and General Counsel since August 2015. Ms. Funk served as a director at Tohono Chul Park, Inc. from 2014 to 2018, the Pima County Bar Association from 2014 to 2016, and the Arizona Women Lawyers Association from 2007 to 2019. Ms. Funk received a J.D. from the University of Arizona College of Law, and a B.A. in Spanish, Political Science, and Economics from the University of Arizona.

Mayra Chimienti was promoted to Chief Operating Officer in March 2022 and previously served as our Vice President, Operations Services since July 2017. Ms. Chimienti joined our Company in 2007 and previously served as our Director of Training & Development from March 2013 to July 2017. Ms. Chimienti has served as a director for the Mister Cares Foundation since April 2020. Ms. Chimienti received a B.A. in Communications from the University of Texas, El Paso.

Casey Lindsay has served as our Vice President, Corporate Development since September 2017. Mr. Lindsay previously served as our Director, Acquisitions from September 2013 to September 2017, and as the Corporate Development Manager for Sonova Holding AG from February 2010 to August 2013. Mr. Lindsay received a B.A. in Finance from Drake University.

| 2022 Proxy Statement |

|

13 | ||||||

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines. A copy of these Corporate Governance Guidelines can be found in the “Governance” section of the “Investor Relations” page of our website located at ir.mistercarwash.com, or by writing to our Corporate Secretary at our offices at 222 E. 5th Street, Tucson, Arizona 85705. Among the topics addressed in our Corporate Governance Guidelines are:

| • | Board independence and qualifications |

| • | Executive sessions of independent directors |

| • | Selection of new directors |

| • | Director orientation and continuing education |

| • | Limits on board service |

| • | Change of principal occupation |

| • | Term limits |

| • | Director responsibilities |

| • | Director compensation |

| • | Conflicts of interest |

| • | Board access to senior management |

| • | Board access to independent advisors |

| • | Board self-evaluations |

| • | Board meetings |

| • | Meeting attendance by directors and non-directors |

| • | Meeting materials |

| • | Board committees, responsibilities and independence |

| • | Succession planning |

Our Board of Directors currently combines the roles of Chairperson of the Board and Chief Executive Officer. These positions are held by John Lai, as our Chairperson and Chief Executive Officer. The Board of Directors has determined that combining these positions currently serves the best interests of the Company and its stockholders. Our Board of Directors believes that our Chief Executive Officer is best situated to serve as Chairperson because he is the director most familiar with our business and industry, and most capable of effectively identifying strategic priorities and leading the consideration and execution of strategy. The Board of Directors believes that the combined position of Chairperson and Chief Executive Officer promotes the development of policy and plans, and facilitates information flow between management and the board of directors, which is essential to effective governance.

We recognize that different leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. Accordingly, the Board will continue to periodically review our leadership structure and make such changes in the future as it deems appropriate and in the best interests of the Company and its stockholders.

Controlled Company Exemption

As Leonard Green & Partners, L.P. (“LGP”) controls more than 50% of the voting power for the election of our directors, we qualify as a “controlled company” within the meaning of the applicable New York Stock Exchange (“NYSE”) rules and regulations (“NYSE rules”). As a “controlled company,” we may elect not to comply with certain corporate governance standards, including the requirements:

| • | that a majority of our board of directors consist of independent directors; |

| • | that our board of directors have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | that our board of directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | for an annual performance evaluation of the nominating and corporate governance committee and compensation committee. |

Although we currently comply with the NYSE rules applicable to companies that do not qualify as a “controlled company” we may at any time and from time to time avail of some or all of the exemptions listed above for so long as we remain a “controlled company.”

| 14 |

|

2022 Proxy Statement | ||||||

Corporate Governance

Under our Corporate Governance Guidelines and the applicable “NYSE rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with us or any of our subsidiaries. In addition, the director must meet the bright-line tests for independence set forth by the NYSE rules.

Our Board has undertaken a review of its composition, the composition of its committees and the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that none of Mmes. Docherty, Rogers and Taylor and Messrs. Danhakl, Galashan, Kirk, Lively, Seiffer and Suer, representing nine of our ten directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors qualifies as “independent” as that term is defined under the NYSE rules. In making these determinations, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in determining their independence, including the director’s beneficial ownership of our common stock and the relationships of our non-employee directors with certain of our significant stockholders.

Our Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition and the responsibilities described below. In addition, from time to time, special committees may be established under the direction of our Board when necessary to address specific issues. Each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee operates under a written charter.

| Director |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance |

|||||||||

| John Danhakl |

||||||||||||

| Susan Docherty |

✓ | CHAIR | ||||||||||

| J. Kristofer Galashan |

✓ | |||||||||||

| Ronald Kirk |

✓ | |||||||||||

| Dorvin Lively |

✓ | |||||||||||

| Veronica Rogers |

✓ | |||||||||||

| Jonathan Seiffer |

✓ | CHAIR | ||||||||||

| Jeffrey Suer |

||||||||||||

| Jodi Taylor |

CHAIR | |||||||||||

Our Audit Committee is responsible for, among other things:

| • | overseeing our accounting and financial reporting process; |

| • | appointing, compensating, retaining and overseeing the work of our independent auditor and any other registered public accounting firm engaged for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us; |

| • | discussing with our independent auditor any audit problems or difficulties and management’s response; |

| • | pre-approving all audit and non-audit services provided to us by our independent auditor (other than those provided pursuant to appropriate preapproval policies established by the Audit Committee or exempt from such requirement under the rules of the SEC); |

| 2022 Proxy Statement |

|

15 | ||||||

Corporate Governance

| • | reviewing and discussing our annual and quarterly financial statements with management and our independent auditor; |

| • | discussing our risk management policies and overseeing management of such risks; |

| • | reviewing and approving or ratifying any related person transactions; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and for the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; |

| • | discussing with management procedures with respect to risk assessment and risk management; and |

| • | preparing the Audit Committee report required by SEC rules. |

Our Audit Committee currently consists of Dorvin Lively, Susan Docherty and Jodi Taylor, with Ms. Taylor serving as chair. All members of our Audit Committee meet the requirements for financial literacy under the applicable NYSE rules and regulations. Our Board of Directors has affirmatively determined that each member of our Audit Committee qualifies as “independent” under the NYSE rules applicable to Audit Committee members and Rule 10A-3 of the Exchange Act of 1934, as amended (the “Exchange Act”) applicable to Audit Committee members. In addition, our Board of Directors has determined that each of Ms. Taylor and Mr. Lively qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K.

Our Compensation Committee is responsible for, among other things:

| • | reviewing and approving corporate goals and objectives with respect to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer’s performance in light of these goals and objectives and setting our Chief Executive Officer’s compensation; |

| • | reviewing and setting or making recommendations to our Board of Directors regarding the compensation of our other executive officers; |

| • | reviewing and making recommendations to our Board of Directors regarding director compensation; |

| • | reviewing and approving or making recommendations to our Board of Directors regarding our incentive compensation and equity-based plans and arrangements; and |

| • | appointing and overseeing any compensation consultants; |

| • | reviewing and discussing annually with management our “Compensation Discussion and Analysis,” to the extent required; and |

| • | preparing the annual Compensation Committee report required by SEC rules, to the extent required. |

Our Compensation Committee currently consists of Susan Docherty, Veronica Rogers and Jonathan Seiffer, with Ms. Docherty serving as chair. Our Board of Directors has determined that each member of our Compensation Committee qualifies as “independent” under the NYSE rules applicable to Compensation Committee members and is a “non-employee director” as defined in Section 16b-3 of the Exchange Act.

Pursuant to the Compensation Committee’s charter, the Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors to assist in carrying out its responsibilities. Before selecting any such consultant, counsel or advisor, the Compensation Committee reviews and considers the independence of such consultant, counsel or advisor in accordance with applicable NYSE rules. We must provide appropriate funding for payment of reasonable compensation to any advisor retained by the Compensation Committee.

Compensation Consultants

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the Compensation Committee has engaged the services of Exequity LLP (“Exequity”) as its independent outside compensation consultant.

As requested by the Compensation Committee, in 2021, Exequity’s services to the Compensation Committee included: assisting us in developing our peer group composition, analyzing benchmarking data with respect to our executives’ overall individual compensation and providing information regarding current trends and developments in executive compensation, equity-based awards, severance agreements and employee stock purchase programs based on our peer group.

| 16 |

|

2022 Proxy Statement | ||||||

Corporate Governance

All executive compensation services provided by Exequity during 2021 were conducted under the direction or authority of the Compensation Committee, and all work performed by Exequity was approved by the Compensation Committee. Neither Exequity nor any of its affiliates maintains any other direct or indirect business relationships with us or any of our subsidiaries. The Compensation Committee evaluated whether any work provided by Exequity raised any conflict of interest for services performed during 2021 and determined that it did not.

Additionally, during 2021, Exequity did not provide any services to us other than regarding executive, employee and director compensation and broad-based plans that do not discriminate in scope, terms, or operation, in favor of our executive officers or directors, and that are available generally to all salaried employees.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other things:

| • | identifying individuals qualified to become members of our Board and ensure the Board has the requisite expertise and consists of persons with sufficiently diverse and independent backgrounds; |

| • | recommending to our Board the persons to be nominated for election as directors and to each committee of the Board; |

| • | developing and recommending to our Board corporate governance guidelines, and reviewing and recommending to our Board proposed changes to our corporate governance guidelines from time to time; and |

| • | overseeing the annual evaluations of our Board, its committees and management. |

Our Nominating and Corporate Governance Committee currently consists of J. Kristofer Galashan, Ronald Kirk and Jonathan Seiffer, with Mr. Seiffer serving as chair. Our Board has determined that each member of our Nominating and Corporate Governance Committee qualifies as “independent” under NYSE rules applicable to Nominating and Corporate Governance Committee members.

Board and Board Committee Meetings and Attendance

During fiscal 2021, our Board of Directors met five times, the Audit Committee met four times, the Compensation Committee met two times and the Nominating and Corporate Governance Committee met two times. In 2021, each of our incumbent directors then-serving attended at least 75% of the meetings of the Board and committees on which he or she served as a member.

Executive sessions, which are meetings of the non-management members of the Board, are regularly scheduled throughout the year. In addition, on a regularly scheduled basis, but no less than once a year, the independent directors meet in a private session that excludes management and any non-independent directors. Each executive session of the independent directors is presided over by the Chair of the Board if the Chair qualifies as independent or, alternatively, by the lead director, if any, if the Chair does not qualify as independent, or a director designated by the independent directors.

Director Attendance at Annual Meeting of Stockholders

Our Corporate Governance Guidelines require the attendance of our Board members at our annual meetings of stockholders. Given the timing of our IPO, we did not hold an annual meeting in 2021.

The Nominating and Corporate Governance Committee is responsible for recommending candidates to serve on the Board and its committees. In considering whether to recommend any particular candidate to serve on the Board or its committees or for inclusion in the Board’s slate of recommended director nominees for election at the annual meeting of stockholders, the Nominating and Corporate Governance Committee considers the criteria set forth in our Corporate Governance Guidelines. Specifically, the Nominating and Corporate Governance Committee considers candidates of high integrity and good judgment who have a record of accomplishment in their chosen fields, and who display the independence of mind and strength of character to effectively represent the best interests of all stockholders and provide practical insights and

| 2022 Proxy Statement |

|

17 | ||||||

Corporate Governance

diverse perspectives. The following table demonstrates the desired relevant skills and experiences of candidates the Nominating Committee considers to positively impact our strategic growth initiatives:

| Strategic Growth Initiative |

Desired Relevant Skills/Experience | |||

| Increase convenience and awareness by expanding our footprint |

|

Growth Leadership — Management and financial stewardship of a growing public company | ||

| Enhance the member experience through digital innovation |

|

Technology or Digital — Demonstrable understanding of technology, digital platforms, or data security and analytics | ||

| Attract and retain diverse talent at every level |

|

Talent Development — Building employee knowledge and skills to maximize their potential development | ||

| Develop next generation wash products and services |

|

Marketing / Brand Management — Development and management of well-known brands or products and services similar to ours | ||

| Make a sustainable impact in the communities in which we operate |

|

People / Community Conscious — Social mission implementation and good stewardship of environmental and human resources. | ||

We consider diversity, such as gender, race, ethnicity and membership of underrepresented communities, a meaningful factor in identifying director nominees and view such diversity characteristics as meaningful factors to consider, but do not have a formal diversity policy. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee may also consider potential conflicts of interest with the candidate’s other personal and profession pursuits, the director’s tenure, performance, past attendance at meetings, and participation in and contributions to the activities of the Board in the context of the Board evaluation process and other perceived needs of the Board.

In identifying prospective director candidates, the Nominating and Corporate Governance Committee may seek referrals from other members of the Board, management, stockholders and other sources, including third party recommendations. The Nominating and Corporate Governance Committee also may, but need not, retain a search firm in order to assist it in identifying candidates to serve as directors of the Company. Mr. Seiffer and Mr. Danhakl were initially recommended to serve as members of our Board by LGP, our controlling stockholder. The Nominating and Corporate Governance Committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. In their consideration, the Board focused primarily on the information discussed in each of the Board member’s biographical information set forth above.

We believe that our directors provide an appropriate mix of experience and skills relevant to the size and nature of our business. This process resulted in the Board’s nomination of the incumbent directors named in this Proxy Statement and proposed for election by you at the Annual Meeting.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders, and such candidates will be considered and evaluated under the same criteria described above. Any recommendation submitted to the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected and must otherwise comply with the requirements under our Bylaws for stockholders to recommend director nominees. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Corporate Secretary, Mister Car Wash, Inc., 222 E. 5th Street, Tucson, Arizona 85705. All recommendations for director nominations received by the Corporate Secretary that satisfy our Bylaws’ requirements relating to such director nominations will be presented to the Nominating and Corporate Governance Committee for its consideration. Stockholders also must satisfy the notification, timeliness, consent and information requirements set forth in our Bylaws. These timing requirements are also described under the caption “Stockholder Proposals and Director Nominations.”

| 18 |

|

2022 Proxy Statement | ||||||

Corporate Governance

The Board of Directors has overall responsibility for risk oversight, including, as part of regular Board and committee meetings, general oversight of executives’ management of risks relevant to the Company. A fundamental part of risk oversight is not only understanding the material risks a company faces and the steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the Board of Directors in reviewing our business strategy is an integral aspect of the Board’s assessment of management’s tolerance for risk and its determination of what constitutes an appropriate level of risk for the Company. While the full Board has overall responsibility for risk oversight, it is supported in this function primarily by its Audit Committee, as well as its Compensation Committee and Nominating and Corporate Governance Committee. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the Board is regularly informed through committee reports about such risks.

The Audit Committee is responsible for reviewing and discussing the Company’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the Company’s exposure to risk is handled, and shall oversee management of financial risks and other material risks applicable to the Company. Through its regular meetings with management and our independent auditors, the Audit Committee reviews and discusses our management’s assessment of risk exposures including liquidity, credit and operational risks and the process in place to monitor such risks and review results of operations, financial reporting and assessments of internal controls over financial reporting. The Compensation Committee assists the Board by overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Nominating and Corporate Governance Committee assists the Board by managing risks associated with the independence of the Board. In addition, our Board receives periodic detailed operating performance reviews from management.

Committee Charters and Corporate Governance Guidelines

Our Corporate Governance Guidelines, charters of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee and other corporate governance information are available under the Governance section of the Investor Relations page of our website located at ir.mistercarwash.com, or by writing to our Corporate Secretary at our offices at 222 E. 5th Street, Tucson, Arizona 85705.

Code of Business Conduct and Ethics

We have adopted a Code of Conduct (the “Code of Conduct”) that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer or controller, or persons performing similar functions. Our Code of Conduct is available under the Governance section of the Investor Relations page of our website located at ir.mistercarwash.com. In addition, we intend to post on our website all disclosures that are required by law or the NYSE rules concerning any amendments to, or waivers of, any provisions of our Code of Conduct.

Our Board of Directors has adopted an Insider Trading Compliance Policy, which applies to all of our directors, officers and employees. The policy prohibits our directors, officers and employees from purchasing financial instruments, such as prepaid variable forward contracts, equity swaps, collars, and exchange funds, or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities. All such transactions involving our equity securities, whether such securities were granted as compensation or are otherwise held, directly or indirectly, are prohibited.

Any stockholder or any other interested party who desires to communicate with our Board of Directors, our non-management directors or any specified individual director, may do so by directing such correspondence to the attention of the Corporate Secretary at our offices at 222 E. 5th Street, Tucson, Arizona 85705. The Corporate Secretary will forward the communication to the appropriate director or directors as appropriate.

| 2022 Proxy Statement |

|

19 | ||||||

Executive and Director Compensation

This section discusses the material components of the executive compensation program for our executive officers who are named in the “Summary Compensation Table” below. In 2021, our “named executive officers”, or “NEOs”, and their positions were as follows:

| • | John Lai, Chairperson, President and Chief Executive Officer; |

| • | Jedidiah Gold, Chief Financial Officer; and |

| • | Lisa Bossard Funk, General Counsel. |

This discussion may contain forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we adopt in the future may differ materially from the currently planned programs summarized in this discussion.

Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers for the years ended December 31, 2021 and 2020.

| Name and Principal Position |

Year | Salary ($)(1) |

Bonus ($) |

Stock Awards ($)(2) |

Option Awards ($)(2) |

Non-Equity Incentive Plan Compensation ($) |

All Other Compensation ($)(3) |

Total ($) | ||||||||||||||||||||||||

| John Lai Chief Executive Officer and Director |

|

2021 2020 |

|

|

821,538 473,077 |

|

|

— 231,186 |

|

|

6,000,000 — |

|

|

6,800,000 — |

|

|

876,247 471,262 |

|

|

248,926 141,076 |

|

|

14,746,711 1,316,601 |

| ||||||||

| Jedidiah Gold Chief Financial Officer |

|

2021 2020 |

|

|

357,692 274,615 |

|

|

— 51,224 |

|

|

1,125,000 — |

|

|

1,275,000 — |

|

|

188,223 70,690 |

|

|

14,320 4,048 |

|

|

2,960,235 400,577 |

| ||||||||

| Lisa Bossard Funk General Counsel |

2021 | 326,623 | — | 375,000 | 425,000 | 125,691 | 13,290 | 1,265,604 | ||||||||||||||||||||||||

| (1) | Amounts reflect the actual base salary paid to each named executive officer in respect of 2021, taking into account salary increases implemented in connection with the IPO. |

| (2) | Amounts reflect the full grant-date fair value of stock awards and option awards granted during fiscal 2021 computed in accordance with ASC Topic 718, rather than the amounts paid to or realized by the named individual. We provide information regarding the assumptions used to calculate the value of all stock awards and option awards made to our directors in Note 14 Stock-based compensation to our consolidated financial statements included elsewhere in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 filed with the SEC. |

| (3) | Amounts reflect (i) a car allowance for Mr. Lai in the amount of $9,000, (ii) cell phone allowances for Messrs. Lai and Gold and Ms. Funk in the amounts of $3,000, $1,200 and $2,400, respectively, (iii) 401(k) matching contributions of $4,350, $3,703 and $3,947 made by us on behalf of Messrs. Lai and Gold and Ms. Funk’s accounts, respectively, (iv) supplemental executive disability insurance premiums of $8,400, $5,142 and $6,943 paid by us on behalf of Messrs. Lai and Gold, and Ms. Funk, respectively, and (v) deferred compensation matching contributions of $601 and $4,275 made by us on behalf of Messrs. Lai and Gold’s accounts, respectively. For Mr. Lai, the amount also reflects the value of personal usage of Company aircraft in the amount of $189,383 and a tax gross-up in the amount of $34,192 associated with his personal usage of Company aircraft. |

Elements of the Company’s Executive Compensation Program

For the year ended December 31, 2021, the compensation for our named executive officers generally consisted of a base salary and cash bonuses. These elements (and the amounts of compensation and benefits under each element) were selected because we believe they are necessary to help us attract and retain executive talent which is fundamental to our success.

| 20 |

|

2022 Proxy Statement | ||||||

Executive and Director Compensation

Below is a more detailed summary of the current executive compensation program as it relates to our named executive officers.

Base Salaries

Our named executive officers receive a base salary to compensate them for the services they provide to our Company. The base salary payable to each named executive officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, role and responsibilities.

Effective June 1, 2021, the base salaries for Mr. Lai and Ms. Funk were increased to $1,000,000 and $350,860, respectively.

Effective January 1, 2022, Mr. Gold’s base salary was increased to $475,000.

The actual salaries paid to each named executive officer for 2021 are set forth in the “Summary Compensation Table” above in the column titled “Salary.”

Bonus Compensation

2021 Bonus Programs