UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Mister Car Wash, Inc.

222 E. 5th Street

Tucson, Arizona 85705

April 10, 2024

Dear Fellow Stockholders:

On behalf of the Board of Directors, I cordially invite you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Mister Car Wash, Inc., a Delaware corporation, which will be held virtually on Thursday, May 23, 2024, at 8:30 a.m., Mountain Standard Time for the purposes described in the accompanying Proxy Statement. Because the Annual Meeting will be held virtually via the Internet, you will not be able to attend the Annual Meeting in person. In order to attend and participate in the Annual Meeting, you must register in advance at www.proxydocs.com/MCW prior to the deadline of May 23, 2024, at 8:30 am Mountain Standard Time. During your registration, you will have an opportunity to submit questions and upon completing your registration, you will receive further instructions via email, including your unique links that will allow you access to the meeting. We will have technicians ready to assist you with any technical difficulties you may have when accessing the virtual meeting website. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting website log-in page.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on March 28, 2024, a Notice of Internet Availability of Proxy Materials. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

Accompanying this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the Annual Meeting.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whether or not you plan to attend the Annual Meeting. Please vote electronically over the Internet, by telephone, by Alexa, or, if you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. If you decide to attend the virtual Annual Meeting, you will be able to vote electronically during the Annual Meeting, even if you have previously submitted your proxy.

On behalf of the Board of Directors and management, it is my pleasure to express our appreciation for your continued support.

|

John Lai |

Chairman, President and Chief Executive Officer |

Mister Car Wash, Inc.

222 E. 5th Street

Tucson, Arizona 85705

Notice of Annual Meeting of Stockholders

Dear Stockholder:

The 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Mister Car Wash, Inc., a Delaware corporation (“the Company”), will be held on Thursday, May 23, 2024. The Annual Meeting will be held in a virtual format only. The Annual Meeting may be accessed by entering the 16-digit control number provided on your proxy card at www.proxydocs.com/MCW. Login will be available starting at 7:30 a.m. and the meeting will begin promptly at 8:30 a.m. Mountain Standard Time, for the following purposes:

These proposals are more fully described in the Proxy Statement accompanying this Notice.

March 28, 2024 has been fixed as the record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting or any continuation, postponement, or adjournment thereof (“Record Date”). Only stockholders of record at the close of business as of the Record Date will be entitled to notice of, and to vote at, the Annual Meeting. A list of stockholders will be available at our headquarters at 222 E. 5th Street, Tucson, Arizona 85705 for a period of at least ten days prior to the Annual Meeting. If you would like an opportunity to view the stockholder list, please contact the Corporate Secretary to make arrangements to view the list.

Additionally, the Proxy Statement and our Annual Report are available free of charge at www.investorelections.com/MCW.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Please read the attached Proxy Statement carefully and promptly vote your shares by Internet, telephone, or Alexa voting as described on your proxy card, or by completing, signing, dating, and returning your proxy card.

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available to stockholders on or about April 10, 2024.

By Order of the Board of Directors |

|

|

John Lai |

Chairman, President and Chief Executive Officer |

Tucson, Arizona

April 10, 2024

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This proxy statement contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements are all statements other than those of historical fact and are inherently subject to a number of risks and uncertainties. All statements that address activities, goals, events, trends or developments that we intend, expect, or believe may occur in the future are forward-looking statements. These statements are often identified by the words, “aim,” “anticipate,” “approximately,” “aspire,” “believe,” “continue,” “could,” “should”, “estimate,” “expect,” “forecast,” “goal”, “hope,” “intend,” “may,” “outlook,” “predict,” “plan,” “project,” “potential,” “seek,” “strive,” “target,” “will,” “would”, or similar words, although not all forward-looking statements contain these identifying words. These forward-looking statements address various matters, including our expected implementation of changes to our programs, the outcomes of newly implemented strategies, achievement of our objectives and estimations of future financial results and drivers. Each forward-looking statement is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. A variety of factors could cause our future results to differ materially from the anticipated events or results expressed in such forward-looking statements, including competition in the car wash industry; our ability to attract and retain members; ability to retain key employees; labor costs and workforce challenges; economic, political and other risks; real estate leases; market instability; serious disruptions or catastrophic events; seasonal influences; our ability to identify and secure suitable sites for new washes; changes in consumer demand; changes in equipment costs; our ability to expand into new markets; our operating costs generally; acquisition activity; our future financial performance and our ability to pay principal and interest on our indebtedness; failures, interruptions or security breaches of our information systems or technology; general economic conditions; compliance with laws, regulations and orders and changes in laws, regulations and applicable accounting standards; outcomes of litigation, legal proceedings and other legal or regulatory matters. Readers should also review Item 1A, Risk Factors, of our Annual Report on Form 10-K filed on February 23, 2024, for a description of important factors that could cause our future results to differ materially from those contemplated by the forward-looking statements made in this proxy statement, as well as other information we file with the U.S. Securities and Exchange Commission (“SEC”). We caution you not to place undue reliance on the forward-looking statements contained in this proxy statement. The forward-looking statements in this proxy statement speak only as of the date of this proxy statement, and we do not undertake any obligation to publicly update or revise our forward-looking statements, except as required by law.

Table of Contents

|

2024 Proxy Statement |

|

i |

Proxy Statement

Mister Car Wash, Inc.

222 E. 5th Street

Tucson, Arizona 85705

Proxy Statement

For the Annual Meeting of Stockholders

to be held on May 23, 2024

Introduction

This proxy statement (the “Proxy Statement”) and our annual report for the fiscal year ended December 31, 2023 (the “Annual Report” and, together with this Proxy Statement, the “proxy materials”) are being furnished by and on behalf of the board of directors (the “Board” or “Board of Directors”) of Mister Car Wash, Inc. (the “Company,” “Mister,” “we,” “us,” or “our”), in connection with the solicitation of proxies by the Company and its Board from holders of the outstanding shares of the Company’s common stock for use at the Company’s 2024 annual meeting of stockholders and at any adjournments or postponements thereof (the “Annual Meeting”).

The Annual Meeting will be held in a virtual format at www.proxydocs.com/MCW on Thursday, May 23, 2024, at 8:30 a.m., Mountain Standard Time. To attend the Annual Meeting virtually, you must register in advance at www.proxydocs.com/MCW.

At the Annual Meeting, stockholders will be asked to vote either directly or by proxy on the following matters as more fully described in this Proxy Statement:

A Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy materials, including this Proxy Statement and our 2023 Annual Report on Form 10-K, is first being mailed to stockholders on or about April 10, 2024. The Notice also provides instructions on how to vote over the Internet, by phone or by mail. If you receive a Notice by mail, you will not receive printed and mailed proxy materials unless you specifically request them.

Information About the Annual Meeting and Voting

When and where will the Annual Meeting be held?

The Annual Meeting will be held virtually via webcast at www.proxydocs.com/MCW on Thursday, May 23, 2024, at 8:30 a.m., Mountain Standard Time. To attend the Annual Meeting, you must register in advance at www.proxydocs.com/MCW.

|

2024 Proxy Statement |

|

1 |

Proxy Statement

What information is contained in this Proxy Statement?

This Proxy Statement contains information relating to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and most highly paid officers, and other required information.

What proposals will be voted on at the Annual Meeting?

There are three proposals scheduled to be voted on at the Annual Meeting as more fully described in this Proxy Statement:

Proposal No. 1: Election of the three Class III director nominees named in this Proxy Statement to serve until the 2027 Annual Meeting and until their respective successors have been duly elected and qualified;

Proposal No. 2: Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2024; and

Proposal No. 3: Approval, on an advisory basis, of the compensation of our named executive officers.

We will also consider any other business that properly comes before the Annual Meeting.

Are there any matters to be voted on at the Annual Meeting that are not included in this Proxy Statement?

At the date this Proxy Statement went to press, we did not know of any matters which may be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If any other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a paper copy of proxy materials?

The rules of the Securities and Exchange Commission (the “SEC”) permit us to furnish proxy materials, including this Proxy Statement and the Annual Report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. Stockholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice and Access Card”) provides instructions on how to access and review on the Internet all proxy materials. The Notice and Access Card also instructs you as to how to vote your shares via the Internet or telephone. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials described in the Notice and Access Card.

What does it mean if I receive more than one Notice and Access Card or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all your shares. To ensure that all your shares are voted, for each Notice and Access Card or set of proxy materials, please submit your proxy by phone, the Internet, or Alexa or, if you received printed copies of the proxy materials, by signing, dating, and returning the enclosed proxy card in the enclosed envelope.

Can I vote my shares by filling out and returning the Notice and Access Card?

No. The Notice and Access Card identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and Access Card and returning it. If you would like a paper proxy card, you should follow the instructions in the Notice and Access Card. The paper proxy card you receive will also provide instructions as to how to vote your shares via the Internet, telephone, or Alexa. Alternatively, you can mark the paper proxy card with how you would like your shares voted, sign and date the proxy card, and return it in the envelope provided.

2 |

|

2024 Proxy Statement |

|

Proxy Statement

Who is entitled to vote at the Annual Meeting?

You may vote all shares of common stock that you owned as of the close of business on the Record Date, March 28, 2024.

As of the Record Date, there were 317,835,082 shares of our common stock issued and outstanding and entitled to be voted at the Annual Meeting.

A list of stockholders will be available at our headquarters at 222 E. 5th Street, Tucson, Arizona 85705 for a period of at least ten days prior to the Annual Meeting.

What are the voting rights of stockholders?

You may cast one vote per share including shares (i) held directly in your name as the stockholder of record and (ii) held for you as the beneficial owner through a stockbroker, bank, or other nominee. There is no cumulative voting.

What is the difference between being a stockholder of record and a beneficial owner?

Many of our stockholders hold their shares through stockbrokers, banks, or other nominees, rather than directly in their own names. As summarized below, there are some differences between being a stockholder of record and a beneficial owner.

Stockholder of record: If your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, you are the stockholder of record, and the Notice and Access Card is being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals named on the proxy card or to vote at the Annual Meeting.

Beneficial owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or other nominee, who is considered to be the stockholder of record. As the beneficial owner, you have the right to tell your nominee how to vote, and you are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you obtain a legal proxy from your nominee authorizing you to do so. Your nominee has sent you instructions on how to direct the nominee’s vote. You may vote by following those instructions and the instructions on the Notice.

What is a proxy holder?

We have designated John Lai, our Chairman, President and Chief Executive Officer, and Jed Gold, our Chief Financial Officer, to hold and vote all properly-tendered proxies (except votes “withheld”). If you have indicated a vote, they will vote accordingly. If you have left a vote blank, they will vote as the Board recommends. While we do not expect any other business to come up for a vote, if it does, they will vote in their discretion.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The holders of a majority in voting power of the common stock issued and outstanding and entitled to vote, present in person, or by remote communication, if applicable, or represented by proxy, constitutes a quorum. If you sign and return your paper proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

Broker non-votes will also be considered present for the purpose of determining whether there is a quorum for the Annual Meeting.

What are “broker non-votes”?

A “broker non-vote” occurs when shares held by a broker, bank, or other nominee in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion. Proposals No.

|

2024 Proxy Statement |

|

3 |

Proxy Statement

1 and 3 are each considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on each such proposal. Therefore, if you are a beneficial owner and do not provide voting instructions to your broker with respect to these matters, it will result in a broker non-vote with respect to such proposals. Broker non-votes, if any, will have no effect on the outcome of Proposals 1 and 3. Proposal No. 2 is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on this proposal.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present or represented at the scheduled time of the Annual Meeting, (i) the Chairman of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in person or by remote communication, if applicable, or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

How do I vote my shares without attending the Annual Meeting?

We recommend that stockholders vote by proxy even if they plan to attend the Annual Meeting and vote in person. If you are a stockholder of record, there are four ways to vote by proxy:

Internet and Telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 8:30 a.m., Mountain Standard Time, on May 23, 2024.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions on how to vote from the bank, broker, or holder of record. You must follow the instructions of such bank, broker, or holder of record for your shares to be voted.

Will there be a question-and-answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted during or prior to the meeting that are pertinent to the Company and the meeting matters, as time permits. Each

4 |

|

2024 Proxy Statement |

|

Proxy Statement

stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

How does the Board recommend that I vote?

The Board recommends that you vote:

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

Proposal |

Votes Required |

Voting Options |

Impact of “Withhold” |

Broker Discretionary Allowed |

Proposal No. 1: Election of Directors |

The plurality of the votes cast. This means that the three nominees receiving the highest number of affirmative “FOR” votes will be elected as Class III directors. |

“FOR” “WITHHOLD”

|

None(1) |

No(3) |

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes) on such matter. |

“FOR” “AGAINST” “ABSTAIN” |

None(2) |

Yes(4) |

|

|

|

|

|

Proposal No. 3: Approval, on an advisory basis, of the compensation of our named executive officers |

The affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes) on such matter. |

“FOR” “AGAINST” “ABSTAIN” |

None(2) |

No(3) |

|

2024 Proxy Statement |

|

5 |

Proxy Statement

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth above, as well as with the description of each proposal in this Proxy Statement.

Who will count the votes?

Representatives of Mediant Communications (“Mediant”) will tabulate the votes, and a representative of Mediant will act as inspector of election.

Can I revoke or change my vote after I submit my proxy?

Yes. Whether you have voted by Internet, telephone. Alexa or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker, or other nominee. You may also change your vote or revoke your proxy at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank, or other nominee) giving you the right to vote the shares.

Your most recent proxy card or telephone, Alexa or Internet proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote at the Annual Meeting.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers, or employees (for no additional compensation) in person or by telephone, electronic transmission, and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

6 |

|

2024 Proxy Statement |

|

Proposal No. 1 Election of Directors

Proposal No. 1 Election of Directors

Board Size and Structure

Our amended and restated certificate of incorporation, as amended (“Certificate of Incorporation”) provides that the number of directors shall be established from time to time by our Board of Directors. Our Board of Directors has fixed the number of directors at ten. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proposal.

Our Certificate of Incorporation provides for a classified Board consisting of three classes, designated as Class I, Class II and Class III. Each class of directors must stand for re-election no later than the third annual meeting of stockholders after their initial appointment or election to the Board, provided that the term of each director will continue until the election and qualification of his or her successor, subject to his or her earlier death, resignation, or removal. Generally, vacancies or newly created directorships on the Board will be filled only by vote of a majority of the directors then in office although less than a quorum, or by the sole remaining director. A director appointed by the Board to fill a vacancy will hold office until the next election of the class for which such director was chosen, subject to the election and qualification of his or her successor and his or her earlier death, resignation, retirement, disqualification, or removal.

Current Directors and Terms

Our current directors and their respective classes and terms are set forth below.

Class I Directors - Current Term Ending at 2025 Annual Meeting |

Class II Directors - Current Term Ending at 2026 Annual Meeting |

Class III Directors - Current Term Ending at 2024 Annual Meeting |

John Danhakl |

J. Kristofer Galashan |

Dorvin Donald Lively |

John Lai |

Ronald Kirk |

Atif Rafiq |

Jonathan Seiffer |

Veronica Rogers |

Jodi Taylor |

|

Jeffrey Suer |

|

Nominees for Director

Messrs. Lively and Rafiq and Ms. Taylor have been nominated by the Board to stand for election as Class III directors at the Annual Meeting. As the directors assigned to Class III, Messrs. Lively and Rafiq and Ms. Taylor’s current terms of service will expire at the Annual Meeting. If elected by the stockholders at the Annual Meeting, Messrs. Lively and Rafiq and Ms. Taylor will each serve for a term expiring at our annual meeting of stockholders to be held in 2027 (the “2027 Annual Meeting”) and the election and qualification of his or her successor or until his or her earlier death, resignation, retirement, disqualification, or removal.

Each person nominated for election as a Class III director has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. We have no reason to believe that any of the Class III director nominees will be unable to unwilling to serve. If, however, prior to the Annual Meeting, the Board of Directors should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for this Class III director nominee will be voted for a substitute nominee as selected by the Board. Alternatively, at the Board’s discretion, the Board may reduce the number of directors.

Information About Board Nominees and Continuing Directors

The following pages contain certain biographical information as of April 10, 2024 for each nominee for director and each director whose term as a director will continue after the Annual Meeting, including all positions he or she holds, his or her principal occupation and business experience for the past five years, and the names of other publicly-held companies of which the director or nominee currently serves as a director or has served as a director during the past five years.

Board Composition and Expertise

We believe that each of our directors has the experience, skills, qualities, and time to successfully perform his or her duties as a director and contribute to our Company’s success. In selecting these directors, the Board determined each to be of

|

2024 Proxy Statement |

|

7 |

Proposal No. 1 Election of Directors

high integrity and good judgment, with a record of accomplishment in their chosen fields, and displaying the independence of mind and strength of character to effectively represent the best interests of all stockholders and provide practical insights and diverse perspectives. Our directors are diverse in age, gender, tenure, ethnic background, and professional experience: 20% identify as female, 10% identify as African American, 20% identify as Asian, and 10% identify as multiracial. Together they produce a cohesive body in terms of board process, collaboration, and mutual respect for differing perspectives. For more information on Mister’s director nomination process, see “Nominating and Corporate Governance Committee — Director Nomination Process” below.

The information presented below regarding each nominee and continuing director also sets forth specific experience, qualifications, attributes, and skills that led our Board of Directors to the conclusion that such individual should serve as a director in light of our business and structure.

Class III Director Nominees for Terms Expiring at the 2027 Annual Meeting of Stockholders

Class III Director Nominees |

Age |

Director Since |

Current Position with Mister |

Dorvin Donald Lively |

65 |

2021 |

Director |

Atif Rafiq |

50 |

2024 |

Director |

Jodi Taylor |

61 |

2021 |

Director |

Dorvin Donald Lively has served as a member of our board of directors since June 2021. Since January 2023, Mr. Lively has served as Executive Chairman and Chief Executive Officer for Buff City Soap, a franchisor of retail stores that sell various soap and body care products. Mr. Lively also served as the President of Planet Fitness, Inc. from January 2019 until October 2022 when he retired from Planet Fitness. He also served as President and Chief Financial Officer from May 2017 to January 2019. Mr. Lively served as Chief Financial Officer of Planet Fitness, Inc. from July 2013 to May 2017. Prior to Planet Fitness, he held several roles at RadioShack from August 2011 to July 2013, including as Executive Vice President, Chief Financial Officer, interim Chief Executive Officer, and Chief Administrative Officer. Prior to RadioShack, Mr. Lively was Chief Financial Officer of Ace Hardware Corp. His experience also includes previous positions at Maidenform Brands, Toys R Us, The Reader's Digest Association and Pepsi-Cola International. Mr. Lively has also served as a director of European Wax Center, Inc. (Nasdaq: EWCZ) since 2021. Mr. Lively earned a B.S. in accounting from the University of Arkansas. We believe Mr. Lively is well-qualified to serve on our board of directors because of his extensive leadership experience, knowledge of corporate finance matters and experience in the consumer services industry.

Atif Rafiq has served as a member of our board of directors since February 2024. Mr. Rafiq is the CEO & Co-Founder of Ritual, an organization that transforms team-based problems through workflow and AI. He previously served as the President of Customers, Commercial, and Growth at MGM Resorts International from 2019 - 2021, leading a significant portfolio across marketing, sales, revenue management, and more. His career trajectory includes key roles such as Global Chief Information Officer and Chief Digital Officer at Volvo Car AB and senior positions at companies like McDonald's Corporation and Amazon.com Inc. Mr. Rafiq's experience extends to board roles, including at Flutter Entertainment plc and CXApp Inc. Mr. Rafiq has also served as a director of KINS Technology Group, Inc. from 2020 to 2023. He holds an MBA from The University of Chicago and a BA in Mathematics-Economics from Wesleyan University, showcasing a blend of technical acumen and leadership excellence across the digital and commercial sectors.

Jodi Taylor has served as a member of our board of directors since June 2021. Ms. Taylor previously served as an executive officer of Container Store Group, Inc., a publicly traded specialty retailer of storage and organization products, until her retirement in March 2021. She was the Chief Financial Officer from December 2007 through August 2020, the Secretary from October 2013 through March 2021, and the Chief Administrative Officer from July 2016 through March 2021. Prior to joining Container Store Group, Inc., Ms. Taylor spent nine years as the Chief Financial Officer and Secretary of Harold’s Stores, Inc., a regional specialty retailer of high-end apparel. Prior to that role, she served as Chief Financial Officer Secretary and Treasurer of Baby Superstore, Inc. from 1994 through 1997. Since August 2020, Ms. Taylor has served on the board of directors of the J.M. Smucker Company since 2020, where she also serves as Chair of the audit committee. She has also served on the board of directors of Wella Company since March 2023, where she also serves as Chair of the audit committee. She has been a certified public accountant since 1984 (inactive since 2021), starting with an accounting role at Deloitte & Touche L.L.P. We believe Ms. Taylor is qualified to serve on our board of directors due to her experience as an executive officer of a public company and her financial and accounting expertise.

8 |

|

2024 Proxy Statement |

|

Proposal No. 1 Election of Directors

Class I Directors Whose Terms Expire at the 2025 Annual Meeting of Stockholders

Class I Directors |

Age |

Director Since |

Current Position with Mister |

John Danhakl |

68 |

2014 |

Director |

John Lai |

60 |

2013 |

Chairman, President, and Chief Executive Officer |

Jonathan Seiffer |

52 |

2014 |

Director |

John Danhakl has served as a member of our board of directors since August 2014. Mr. Danhakl is Managing Partner of Leonard Green & Partners, L.P., a private equity investing firm based in Los Angeles with over $40 billion of committed capital raised since inception. The firm partners with experienced management teams and often with founders to invest in market-leading companies. Mr. Danhakl joined LGP in 1995. Previously, Mr. Danhakl was a Managing Director in the Los Angeles office of Donaldson, Lufkin & Jenrette ("DLJ"). Prior to DLJ, Mr. Danhakl was a Vice President in corporate finance at Drexel Burnham Lambert, Inc. Mr. Danhakl presently serves on the Board of Directors of IQVIA Holdings, Inc. since February 2010, Life Time Group Holdings, Inc. since June 2015. He is a 1980 graduate of the University of California at Berkeley and received an M.B.A. in 1985 from Harvard Business School. We believe Mr. Danhakl is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies, and his experience as a financial analyst.

John Lai has served as the Chairman of our Board of Directors since 2021, and as our President, Chief Executive Officer and as a member of the Board since June 2013. Mr. Lai has been with Mister Car Wash, Inc, and its predecessor entities since 2002, serving as Vice President of Market Development until assuming the role of President and Chief Executive Officer. Mr. Lai has served as a director at the Southern Arizona Leadership Council since December 2019. Mr. Lai received a B.S. from the University of Arizona. We believe that Mr. Lai is qualified to serve on our board of directors based on his understanding of our business and operations and perspective as our President and Chief Executive Officer.

Jonathan Seiffer has served as a member of our board of directors since August 2014. Mr. Seiffer is a Senior Partner at Leonard Green & Partners, L.P. a private equity investing firm, which he joined as an Associate in October 1994. Mr. Seiffer has also served on the board of directors of Signet Jewelers, LTD since 2019, AerSale Corporation since December 2020 and previously served on the Board of Directors of BJ’s Wholesale Club from 2011 to 2020. Mr. Seiffer obtained a B.S. in finance and systems engineering from the University of Pennsylvania. We believe Mr. Seiffer is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies.

Class II Directors Whose Terms Expire at the 2026 Annual Meeting of Stockholders

Class II Directors |

Age |

Director Since |

Current Position at Mister |

|

|

|

|

J. Kristofer Galashan |

46 |

2014 |

Director |

|

|

|

|

Ronald Kirk |

69 |

2021 |

Director |

|

|

|

|

Veronica Rogers |

46 |

2021 |

Director |

|

|

|

|

Jeffrey Suer |

38 |

2014 |

Director |

J. Kristofer Galashan has served as a member of our board of directors since August 2014. Mr. Galashan is a Partner of Leonard Green & Partners, L.P. where he joined as an associate in 2002. Mr. Galashan serves on the board of directors of the Container Store Group, Inc. since August 2007, and Life Time Group Holdings, Inc. since June 2015, and previously served on the board of directors for USHG Acquisition Corp. from February 2021 until December 2022, BJ’s Wholesale Club Holdings, Inc. from 2011 to 2019. Mr. Galashan earned a B.A. in Honors Business Administration from the Richard Ivey School of Business at the University of Western Ontario. We believe Mr. Galashan is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies.

Ronald Kirk has served as a member of our board of directors since October 2021. Mr. Kirk has been Senior Of Counsel at the law firm of Gibson, Dunn & Crutcher LLP since April 2013. From 2009 until 2013, Mr. Kirk served as the U.S. Trade Representative under President Obama, where he focused on the development and enforcement of U.S. intellectual property law. Prior to serving as U.S. Trade Representative, from 2005 to 2009, Mr. Kirk was a partner of the law firm of Vinson & Elkins LLP and, from 1994 to 2005, was a partner in the Corporate Securities Practice of Gardere Wynne & Sewell LLP. Mr. Kirk currently serves on the board of Texas Instruments Incorporated and the board of Macquarie Infrastructure Holdings, LLC. Mr. Kirk received a B.A. in Political Science and Sociology from Austin College and a J.D. from University

|

2024 Proxy Statement |

|

9 |

Proposal No. 1 Election of Directors

of Texas at Austin School of Law. We believe Mr. Kirk is qualified to serve on our board of directors due to his broad leadership experience and experience as an independent director for other public companies.

Veronica Rogers has served as a member of our board of directors since October 2021. Currently Ms. Rogers is a DCI Fellow of Stanford University. Ms. Rogers has served as Senior Vice President, Head of Global Sales and Business Operations of Sony Interactive Entertainment LLC from January 2020 to April 2023 where she led go-to-market strategy globally both physically and digitally, including PlayStation Store and subscription Services with more than 45 million subscribers. From 2006 to 2020, she served in various managerial roles in sales, marketing, and business development at Microsoft Corporation, most recently as Vice President, Device Partner, Sales from 2018 to 2020. Ms. Rogers received a B.A. in Economics and a Master of Arts degree in Economics from the University of Cambridge, as well as a Master of Science degree in European Political Economy and Political Science from the London School of Economics. We believe Ms. Rogers is qualified to serve on our board of directors due to her experience as an executive officer of public companies.

Jeffrey Suer has served as a member of our board of directors since August 2014. Mr. Suer is a Partner of Leonard Green & Partners, L.P. a private equity investing firm. Prior to joining Leonard Green & Partners in August 2013, Mr. Suer previously served as a private equity associate at Apollo Global Management LLC and a mergers and acquisitions analyst at Morgan Stanley. Mr. Suer received an M.B.A. from Harvard Business School, and a B.S. in Mathematics/Economics from the University of California, Los Angeles. We believe Mr. Suer is qualified to serve on our board of directors due to his extensive experience investing in and supporting high-growth, market-leading companies.

|

Board Recommendation

|

|

|

|

|

|

|

|

The Board of Directors unanimously recommends a vote FOR the election of each of Dorvin Donald Lively, Atif Rafiq, and Jodi Taylor as a Class III director to hold office until the 2027 Annual Meeting and until his or her respective successor has been duly elected and qualified.

|

||

10 |

|

2024 Proxy Statement |

|

Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm

Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm

Appointment of Independent Registered Public Accounting Firm

The Audit Committee appoints our independent registered public accounting firm. In this regard, the Audit Committee evaluates the qualifications, performance and independence of our independent registered public accounting firm and determines whether to re-engage our current firm. As part of its evaluation, the Audit Committee considers, among other factors, the quality and efficiency of the services provided by the firm, including the performance, technical expertise, industry knowledge and experience of the lead audit partner and the audit team assigned to our account; the overall strength and reputation of the firm; the firm’s global capabilities relative to our business; and the firm’s knowledge of our operations. Deloitte & Touche LLP has served as our independent registered public accounting firm since 2018. Upon consideration of these and other factors, the Audit Committee has appointed Deloitte & Touche LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Although ratification is not required by our amended and restated bylaws (“Bylaws”) or otherwise, the Board is submitting the selection of Deloitte & Touche LLP to our stockholders for ratification because we value our stockholders’ views on the Company’s independent registered public accounting firm, and it is a good corporate governance practice. If our stockholders do not ratify the selection, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

Representatives of Deloitte & Touche LLP are expected to attend the Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

Fees Paid to Deloitte & Touche LLP

The following table sets forth the fees of Deloitte & Touche LLP, our independent registered public accounting firm, billed to the Company in each of the last two fiscal years.

|

Year Ended December 31, |

|

||||

|

2023 |

|

2022 |

|

||

Audit Fees |

$ |

1,494,913 |

|

$ |

1,398,000 |

|

Audit-Related Fees |

|

15,000 |

|

|

35,000 |

|

Tax Fees |

|

430,227 |

|

|

502,700 |

|

All Other Fees |

|

— |

|

|

— |

|

Total |

$ |

1,940,140 |

|

$ |

1,935,700 |

|

Audit fees for the fiscal years ended December 31, 2023, and December 31, 2022, consisted of fees billed for professional services rendered for the audit and interim reviews of Mister’s financial statements.

Audit-related fees for the fiscal years ended December 31, 2023, and December 31, 2022, consisted of fees billed for work performed in connection with SEC filings related to registration statements.

Tax fees for the fiscal years ended December 31, 2023, and December 31, 2022, consisted of fees related to federal and state income tax and indirect tax return compliance and consulting matters.

Pre-Approval Policies and Procedures

The formal written charter for our Audit Committee requires that the Audit Committee pre-approve all audit services to be provided to us, whether provided by our principal auditor or other firms, and all other services (review, attest and non-audit) to be provided to us by our independent registered public accounting firm, other than de minimis non-audit services approved in accordance with applicable SEC rules.

|

2024 Proxy Statement |

|

11 |

Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by our independent registered public accounting firm may be pre-approved. The Pre-Approval Policy generally provides that the Audit Committee will not engage an independent registered public accounting firm to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by our independent registered public accounting firm has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any member of the Audit Committee to whom the committee delegates authority to make pre-approval decisions must report any such pre-approval decisions to the Audit Committee at its next scheduled meeting. If circumstances arise where it becomes necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval categories or above the pre-approved amounts, the Audit Committee requires pre-approval for such additional services or such additional amounts. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence.

On an annual basis, the Audit Committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by our independent registered accounting firm without first obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations.

All services reported in the Audit, Audit-Related, Tax and All Other Fees categories above were approved by the audit committee. The above-described services provided to us by Deloitte & Touche LLP prior to our initial public offering, effective June 24, 2021 (“IPO”) were provided under engagements entered into prior to our adoption of our pre-approval policies and, following our IPO, in accordance with such policies.

|

Board Recommendation

|

|

|

|

|

|

|

|

The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

|

||

12 |

|

2024 Proxy Statement |

|

Proposal No. 2 Ratification of Appointment of Independent Registered Public Accounting Firm

Audit Committee Report

The audit committee operates pursuant to a charter which is reviewed annually by the audit committee. Additionally, a brief description of the primary responsibilities of the audit committee is included in this Proxy Statement under the discussion of “Corporate Governance – Audit Committee.” Under the audit committee charter, management is responsible for preparation, presentation and integrity of the Company’s financial statements, the appropriateness of accounting principles and financial reporting policies and for establishing and maintaining our internal control over financial reporting. The independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States.

In the performance of its oversight function, the audit committee reviewed and discussed with management and Deloitte & Touche LLP, as the Company’s independent registered public accounting firm, the Company’s audited financial statements of the fiscal year ended December 31, 2023, and internal control over financial reporting. The audit committee also discussed with the Company’s independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the SEC. In addition, the audit committee received and reviewed the written disclosures and letters from the Company’s independent registered public accounting firm required by applicable requirements of the PCAOB, regarding such independent registered accounting firm’s communications with the audit committee concerning independence and discussed with the Company’s independent registered public accounting firm their independence from the Company.

Based upon review and discussions described in the preceding paragraph, the audit committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC.

Submitted by the Audit Committee of the Company’s Board of Directors:

Jodi Taylor (Chair)

Dorvin Donald Lively

Ronald Kirk

|

2024 Proxy Statement |

|

13 |

Proposal No. 3 Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to Reflect Delaware Law Provisions Regarding Officer Exculpation

Proposal No. 3 Vote to Approve, on an Advisory Basis, Our Named Executive Officer Compensation

The Compensation Discussion and Analysis beginning on page 23 of this Proxy Statement describes our executive compensation program and the compensation of our named executive officers for the fiscal year ended December 31, 2023. The Board of Directors is asking stockholders to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers by voting “FOR” the following resolution:

“RESOLVED, that the stockholders of Mister Car Wash, Inc. APPROVE, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.”

As described in detail in the section entitled “Compensation Discussion and Analysis”, we maintain an executive compensation program that ties pay to performance and seeks to:

Based on the result of the say-on-pay frequency vote held at our 2023 annual meeting of stockholders, we expect to hold a vote to approve, on an advisory basis, the compensation of our named executive officers on an annual basis going forward.

|

Board Recommendation

|

|

|

|

|

|

|

|

The Board recommends a vote FOR Proposal 3, Vote to Approve, on an Advisory Basis, our Named Executive Officer Compensation

|

||

14 |

|

2024 Proxy Statement |

|

Corporate Governance

Named Executive Officers

The table below identifies and sets forth certain biographical and other information regarding our named executive officers as of April 10, 2024. There are no family relationships among any of our named executive officers or directors.

Named Executive Officer |

Age |

Position |

In Current Position Since |

John Lai |

60 |

President, Chief Executive Officer and Director |

2013 |

Jedidiah Gold |

44 |

Chief Financial Officer |

2019 |

Mary Porter |

53 |

Chief People Officer |

2023 |

Mayra Chimienti |

40 |

Chief Operating Officer |

2022 |

Markus Hartmann |

60 |

General Counsel |

2022 |

See page 8 of this Proxy Statement for the biography of John Lai.

Jedidiah Gold has served as our Treasurer and Chief Financial Officer since July 2019. Mr. Gold previously served as Senior Director Finance, Assistant Treasurer at Yum Brands, Inc. from May 2016 to July 2019, and as Chief Financial Officer MENAPak at KFC Corporation from October 2014 to May 2016. Mr. Gold received a M.B.A. in Finance and Accounting from Indiana University and a B.S. in accounting from the University of Utah.

Mary Porter became our first Chief People Officer in 2023. Ms. Porter previously served as the Vice President of Human Resources for Nordstrom from January 2018 to April 2023, supporting Nordstrom and Nordstrom Rack locations across both the U.S. and Canada, a position she achieved as the culmination of a 27-year long journey with the company. From HR compliance to Talent Acquisition to strategic business support, Mary has experience across many Human Resources functions. Mary earned a Bachelor of Arts degree from the University of Washington.

Mayra Chimienti was promoted to Chief Operating Officer in March 2022 and previously served as our Vice President, Operations Services since July 2017. Ms. Chimienti joined our Company in 2007 and previously served as our Director of Training & Development from March 2013 to July 2017. Ms. Chimienti has served as a director for the Mister Cares Foundation since April 2020. Ms. Chimienti received a B.A. in Media Advertising from the University of Texas, El Paso.

Markus Hartmann has served as our General Counsel since October 2022. Mr. Hartmann previously served as Senior Compliance Officer for Stryker Corporation (Spine Division) from May 2021 to October 2022, as Vice President -General Counsel and Corporate Secretary for Carrols Restaurant Group, Inc. from February 2020 to March 2021, and as Vice President – Technical Compliance NAFTA for Mercedes-Benz Research & Development North America, Inc. (A Daimler company) from November 2018 to February 2020. Mr. Hartmann received a J.D. from Harvard Law School, an M.B.A. from Le Moyne College and a B.A. in Political Science from Colorado College.

|

2024 Proxy Statement |

|

15 |

Corporate Governance

Corporate Governance

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines. A copy of these Corporate Governance Guidelines can be found in the “Governance” section of the “Investor Relations” page of our website located at: www.ir.mistercarwash.com, or by writing to our Corporate Secretary at our offices at 222 E. 5th Street, Tucson, Arizona 85705. In addition to the matters included in our Corporate Governance Guidelines, we strive to adopt practices that will promote the long-term interests of the Company and its stockholders including:

• Board Independence and Qualifications |

• Independent Executive Compensation Consultant |

• Established Whistleblower ("Speaking Up") Policy |

• Annual Board and Committee Self-Evaluations |

• Regular Board and Committee Executive Sessions of Non-Management Independent Directors |

• Audit Committee Approval Required for Related Party Transactions |

• Established Executive Officer and Non-Employee Director Stock Ownership Policy |

• Director Orientation and Continuing Education |

• Accountability. Each share of our common stock as of record date is entitled to one vote per proposal presented to stockholders at our Annual Meeting of Stockholders. |

• Clawback, Anti-Hedging, Anti-Short Sale and Anti-Pledging Policies for Directors, Executive Officers, and other Employees |

|

|

|

|

Board Leadership Structure

The Chairman of the Board leads the Board and oversees Board meetings and the delivery of information necessary for the Board’s informed decision making. The Chairman also serves as the principal liaison between the Board and our management. At this time, our Board believes that it is in the best interests of the Company and its stockholder that the positions of Chair and CEO be held by the same person, as this combination provides unified leadership and direction in the management of the Company, contributing to cohesive, strong, and effective long-term vision and strategy. These positions are currently held by John Lai. Our Board of Directors believes that our Chief Executive Officer is best situated to serve as Chairman because, as the Company’s Chief Executive Officer, he has a deep understanding of our business and industry, and is best placed to identify key business and strategic priorities, critical issues that require Board attention and facilitate timely and effective communication between the Board and management, which is essential to effective governance.

We recognize that different leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. Accordingly, the Board will continue to periodically review our leadership structure and make such changes in the future as it deems appropriate and in the best interests of the Company and its stockholders.

Controlled Company Exemption

As Leonard Green & Partners, L.P. (“LGP”) controls more than 50% of the voting power for the election of our directors, we qualify as a “controlled company” within the meaning of the applicable New York Stock Exchange (“NYSE”) rules and regulations (“NYSE rules”). As a “controlled company,” we may elect not to comply with certain corporate governance standards, including the requirements:

16 |

|

2024 Proxy Statement |

|

Corporate Governance

Although we currently comply with the NYSE rules applicable to companies that do not qualify as a “controlled company” we may at any time and from time-to-time avail of some or all of the exemptions listed above for so long as we remain a “controlled company.”

Director Independence

Under our Corporate Governance Guidelines and the applicable NYSE rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with us or any of our subsidiaries. In addition, the director must meet the bright-line tests for independence set forth by the NYSE rules.

Our Board has undertaken a review of its composition, the composition of its committees and the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that none of Mmes. Rogers and Taylor and Messrs. Danhakl, Galashan, Kirk, Lively, Rafiq, Seiffer and Suer, representing nine of our ten directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors qualifies as “independent” as that term is defined under the NYSE rules. In making these determinations, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in determining their independence, including the director’s beneficial ownership of our common stock and the relationships of our non-employee directors with certain of our significant stockholders.

Board Committees

Our Board of Directors has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee, each of which has the composition and the responsibilities described below. In addition, from time to time, special committees may be established under the direction of our Board when necessary to address specific issues. Each of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee operates under a written charter, available on the Company website at www.ir.mistercarwash.com.

Director |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

John Danhakl |

|

|

|

J. Kristofer Galashan |

|

✓ |

✓ |

Ronald Kirk |

✓ |

|

✓ |

John Lai |

|

|

|

Dorvin Donald Lively |

✓ |

|

|

Atif Rafiq |

|

|

✓ |

Veronica Rogers |

|

CHAIR |

|

Jonathan Seiffer |

|

✓ |

CHAIR |

Jeffrey Suer |

|

|

|

Jodi Taylor |

CHAIR |

|

|

|

2024 Proxy Statement |

|

17 |

Corporate Governance

Audit Committee

Our Audit Committee is responsible for, among other things:

Our Audit Committee currently consists of Dorvin Donald Lively, Ronald Kirk and Jodi Taylor, with Ms. Taylor serving as chair. All members of our Audit Committee meet the requirements for financial literacy under the applicable NYSE rules and regulations. Our Board of Directors has affirmatively determined that each member of our Audit Committee qualifies as “independent” under the NYSE rules applicable to Audit Committee members and Rule 10A-3 of the Exchange Act of 1934, as amended (the “Exchange Act”) applicable to Audit Committee members. In addition, our Board of Directors has determined that each of Ms. Taylor and Mr. Lively qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K.

Compensation Committee

Our Compensation Committee is responsible for, among other things:

Our Compensation Committee currently consists of J. Kristofer Galashan, Jonathan Seiffer, and Veronica Rogers, with Ms. Rogers serving as chair. Our Board of Directors has determined that each member of our Compensation Committee qualifies as “independent” under the NYSE rules applicable to Compensation Committee members and is a “non-employee director” as defined in Section 16b-3 of the Exchange Act.

Pursuant to the Compensation Committee’s charter, the Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel, and other advisors to assist in carrying out its responsibilities. Before

18 |

|

2024 Proxy Statement |

|

Corporate Governance

selecting any such consultant, counsel or advisor, the Compensation Committee reviews and considers the independence of such consultant, counsel, or advisor in accordance with applicable NYSE rules. We must provide appropriate funding for payment of reasonable compensation to any advisor retained by the Compensation Committee.

Compensation Consultants

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the Compensation Committee has engaged the services of Exequity LLP (“Exequity”) as its independent outside compensation consultant.

As requested by the Compensation Committee, in 2023, Exequity’s services to the Compensation Committee included: providing named executive officer compensation advisory services, helping evaluate our compensation philosophy and objectives and providing guidance in administering our executive compensation program.

All named executive officer compensation services provided by Exequity during 2023 were conducted under the direction or authority of the Compensation Committee, and all work performed by Exequity was approved by the Compensation Committee. Neither Exequity nor any of its affiliates maintains any other direct or indirect business relationships with us or any of our subsidiaries. The Compensation Committee evaluated whether any work provided by Exequity raised any conflict of interest for services performed during 2023 and determined that it did not.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other things:

Our Nominating and Corporate Governance Committee currently consists of J. Kristofer Galashan, Ronald Kirk, Atif Rafiq, and Jonathan Seiffer, with Mr. Seiffer serving as chair. Our Board has determined that each member of our Nominating and Corporate Governance Committee qualifies as “independent” under NYSE rules applicable to Nominating and Corporate Governance Committee members.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2023, those who served on the Compensation Committee were Veronica Rogers, Jonathan Seiffer, and J. Kristofer Galashan. During 2023, no member of the Compensation Committee was an officer or employee of the Company at any time during 2023 or as of the date of this Proxy Statement, nor was any such individual a former officer of the Company. In 2023, no member of our Compensation Committee had any relationship or transaction with us that would require disclosure as a “related person transaction” under Item 404 of SEC Regulation S-K in this Proxy Statement other than the information provided under the section entitled “Certain Transactions with Related Persons.” See also “Compensation Discussion and Analysis – 2023 Director Compensation” for a description of compensation paid to members of the Compensation Committee.

Board and Board Committee Meetings and Attendance

During fiscal 2023, our Board of Directors met five times, the Audit Committee met eight times, the Compensation Committee met four times and the Nominating and Corporate Governance Committee met five times. In 2023, each of our directors attended at least 75% of the meetings of the Board and committees on which he or she served as a member.

|

2024 Proxy Statement |

|

19 |

Corporate Governance

Independent Director Executive Sessions

Our independent directors meet in executive sessions without management on a regularly scheduled basis. A presiding director is selected on a rotating basis from among the independent directors in alphabetical order of last name and serves as the lead non-management director of those sessions.

Director Attendance at Annual Meeting of Stockholders

Our Corporate Governance Guidelines require the attendance of our Board members at our annual meetings of stockholders. All members of our Board of Directors attended the annual meeting of stockholders held in 2023.

Director Nomination Process

The Nominating and Corporate Governance Committee is responsible for recommending candidates to serve on the Board and its committees. In considering whether to recommend any particular candidate to serve on the Board or its committees or for inclusion in the Board’s slate of recommended director nominees for election at the annual meeting of stockholders, the Nominating and Corporate Governance Committee considers the criteria set forth in our Corporate Governance Guidelines. Specifically, the Nominating and Corporate Governance Committee considers candidates of high integrity and good judgment who have a record of accomplishment in their chosen fields, and who display the independence of mind and strength of character to effectively represent the best interests of all stockholders and provide practical insights and diverse perspectives. The following table demonstrates the desired relevant skills and experiences of candidates the Nominating and Corporate Governance Committee considers to positively impact our strategic growth initiatives:

Strategic Initiatives |

|

Desired Relevant Skills/Experience |

|

|

|

Increase convenience and awareness by expanding our Footprint and increasing retail and membership traffic |

|

Growth Leadership — Management and financial stewardship of a growing public company |

|

|

|

Enhance the member experience through digital innovation |

|

Technology or Digital — Demonstrable understanding of technology, digital platforms, or data security and analytics |

|

|

|

Attract and retain diverse talent at every level |

|

Talent Development — Building employee knowledge and skills to maximize their potential development |

|

|

|

Develop next generation wash products and services |

|

Marketing / Brand Management — Development and management of well-known brands or products and services similar to ours |

|

|

|

Make a sustainable impact in the communities in which we operate |

|

People / Community Conscious — Social mission implementation and good stewardship of environmental and human resources. |

In addition to the skills and experiences highlighted in the table above, the Nominating and Corporate Governance Committee also considers the following criteria when evaluating director candidates:

We consider diversity, such as gender, race, ethnicity and membership of underrepresented communities, a meaningful factor in identifying director nominees and view such diversity characteristics as meaningful factors to consider, but do not have a formal diversity policy. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. In determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee may also consider potential conflicts of interest with the candidate’s other personal and professional pursuits, the director’s tenure, performance, past attendance at meetings, and participation in and contributions to the activities of the Board in the context of the Board evaluation process and other perceived needs of the Board.

20 |

|

2024 Proxy Statement |

|

Corporate Governance

In identifying prospective director candidates, the Nominating and Corporate Governance Committee may seek referrals from other members of the Board, management, stockholders, and other sources, including third party recommendations. The Nominating and Corporate Governance Committee also may, but need not, retain a search firm in order to assist it in identifying candidates to serve as directors of the Company. Mr. Lively, Mr. Rafiq, and Ms. Taylor, our Class III director nominees, were recommended to serve as members of our Board by a third-party search firm. The Nominating and Corporate Governance Committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. In their consideration, the Board focused primarily on the information discussed in each of the Board member’s biographical information set forth above.

We believe that our directors provide an appropriate mix of experience and skills relevant to the size and nature of our business. This process resulted in the Board’s nomination of the incumbent directors named in this Proxy Statement and proposed for election by you at the Annual Meeting.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders, and such candidates will be considered and evaluated under the same criteria described above. Any recommendation submitted to the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected and must otherwise comply with the requirements under our Bylaws for stockholders to recommend director nominees. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Corporate Secretary, Mister Car Wash, Inc., 222 E. 5th Street, Tucson, Arizona 85705. All recommendations for director nominations received by the Corporate Secretary that satisfy our Bylaws’ requirements relating to such director nominations, will be presented to the Nominating and Corporate Governance Committee for its consideration. Stockholders also must satisfy the notification, timeliness, consent, and information requirements set forth in our Bylaws. These timing requirements are also described under the caption “Stockholder Proposals and Director Nominations.”

In addition, we are party to the Stockholders Agreement (as defined below) which provides for, among other things, certain director nominee designation rights in favor of LGP (each such nominee, an "LGP Designee"). Each of John Danhakl, J. Kristofer Galashan, Jonathan Seiffer and Jeffrey Suer are LGP Designees. See "Certain Transactions with Related Parties - Stockholders Agreement" below.

Board Role in Risk Oversight

The Board of Directors has overall responsibility for overseeing the Company’s strategy and risk management process. As part of regular Board and committee meetings, the Board focuses on the Company’s general management of risks relevant to the Company. A fundamental part of risk oversight is not only understanding the material risks a company faces and the steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. The involvement of the Board of Directors in reviewing our business strategy is an integral aspect of the Board’s assessment of management’s tolerance for risk and its determination of what constitutes an appropriate level of risk for the Company. While the full Board has retained general oversight of risks, including cyber-related risks and ESG related risks, it discharges its duties both as a full board and through its standing committees. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the Board is also regularly informed of particular risk management matters through committee reports and in connection with its general oversight and approval of corporate matters.

The Audit Committee is responsible for reviewing and discussing the Company’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the Company’s exposure to risk (including risks related to cybersecurity and other technology issues) is handled, and shall oversee management of financial risks and other material risks applicable to the Company. Through its regular meetings with management and our independent auditors, the Audit Committee reviews and discusses our management’s assessment of risk exposures including liquidity, credit and operational risks and the process in place to monitor such risks and review results of operations, financial reporting, and assessments of internal controls over financial reporting. The Compensation Committee assists the Board by overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Nominating and Corporate Governance Committee assists the Board by managing risks associated with the independence of the Board. In addition, our Board receives periodic detailed operating performance reviews from management.

|

2024 Proxy Statement |

|

21 |

Corporate Governance

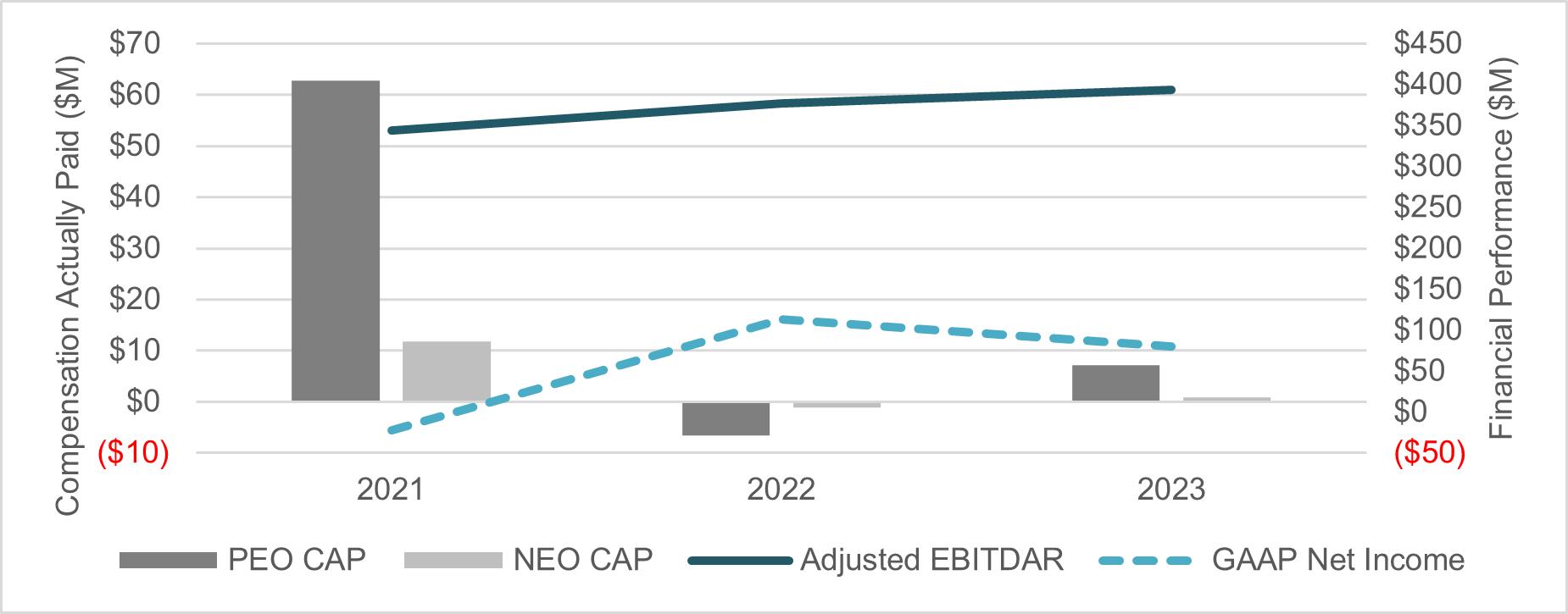

The Company’s management is responsible for day-to-day risk management, including the primary monitoring and testing function for company-wide policies and procedures, and management of the day-to-day oversight of the risk management strategy for the ongoing business of the Company. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the enterprise, strategic, financial, operational, and compliance and reporting levels. With respect to cybersecurity and other information technology risks, management provides periodic reports to the Audit Committee, as well as our plans to mitigate cybersecurity risks and to respond to any breaches.